- 26 May 2025

- 1 Minute to read

- Print

- DarkLight

Automatic Reconciliation Reports

- Updated on 26 May 2025

- 1 Minute to read

- Print

- DarkLight

Reconciliation reports will match the expense transactions in your CSV bank statement to expenses in your workspace (based on the exact date & total). It’ll let you see which receipts are missing and allow you to edit the expense if any corrections are needed.

After reconciling, you’ll receive two CSV files within 48 hours. We’ll also reach out to you if there are any issues.

The “Reconciled” file will contain your original transactions and data from your workspace

The “Unmatched” file will contain expenses that were in the bank statement’s date range, but could not be matched to the bank statement

Formatting the CSV file

The date format of the date column should be MM/DD/YYYY (e.g., 10/31/2025 or 1/25/2025)

The total format must be positive values only (e.g., 1000, 1000.00, or 1,000.00)

Remove any rows above the “Date” and “Total” header rows. Be sure to include a header row if there isn’t one.

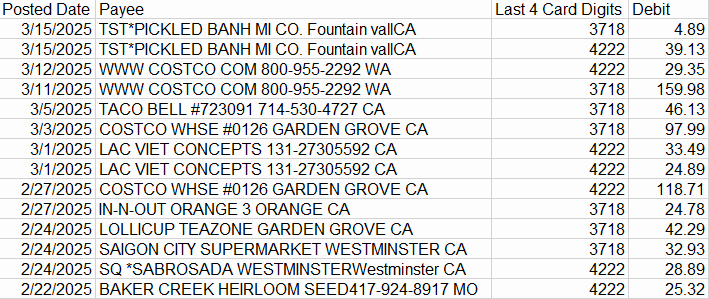

Examples of accepted formats

.png)

The date and total are formatted correctly in both images, and there is no extra rows above the header row.

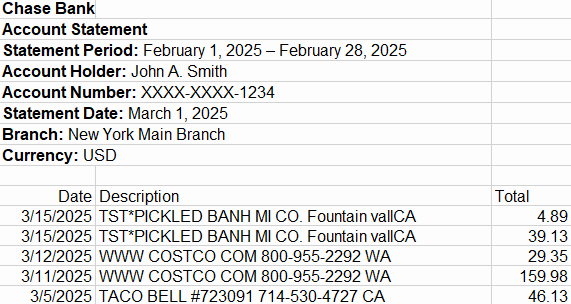

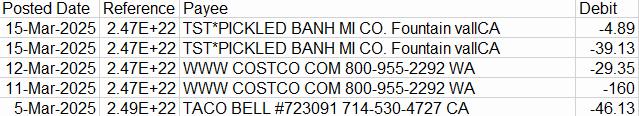

Examples of bad formats

The date and total is formatted correctly, but it has additional rows above them. Deleting all rows above the “Date”, “Description”, and “Total” header row would fix the issue.

The date is formatted incorrectly and the total has negative values in them.

How to reconcile a CSV

To reconcile a CSV, click the “Reconcile” tab and drag the CSV from your computer to the upload zone, or click the “Drag & drop credit card statement” and select the CSV file you want to reconcile.